RELEASE

Blue Cross Blue Shield of Michigan and Blue Care Network Streamline Plans for 2025 ACA Marketplace Open Enrollment

Brianna Neace

| 3 min read

DETROIT, June 5, 2024 – Blue Cross Blue Shield of Michigan and Blue Care Network are streamlining plan options to make the health care shopping experience easier to navigate for people selecting individual health plans during the upcoming 2025 ACA Marketplace open enrollment period.

Recently updated guidelines from the Centers for Medicare & Medicaid Services for 2025 further reduced the number of non-standardized plan options that issuers of qualified health plans can offer through Marketplaces on the Federal platform. These restrictions, initially introduced in 2024, are intended to help simplify the health care shopping experience for consumers to more easily compare options and choose the plan best-suited for their health care needs. Under these guidelines, Blue Cross and BCN will close five plans while maintaining a variety of coverage options with 38 plan offerings for 2025 enrollment – four Gold, 17 Silver, 14 Bronze and three Catastrophic level offerings.

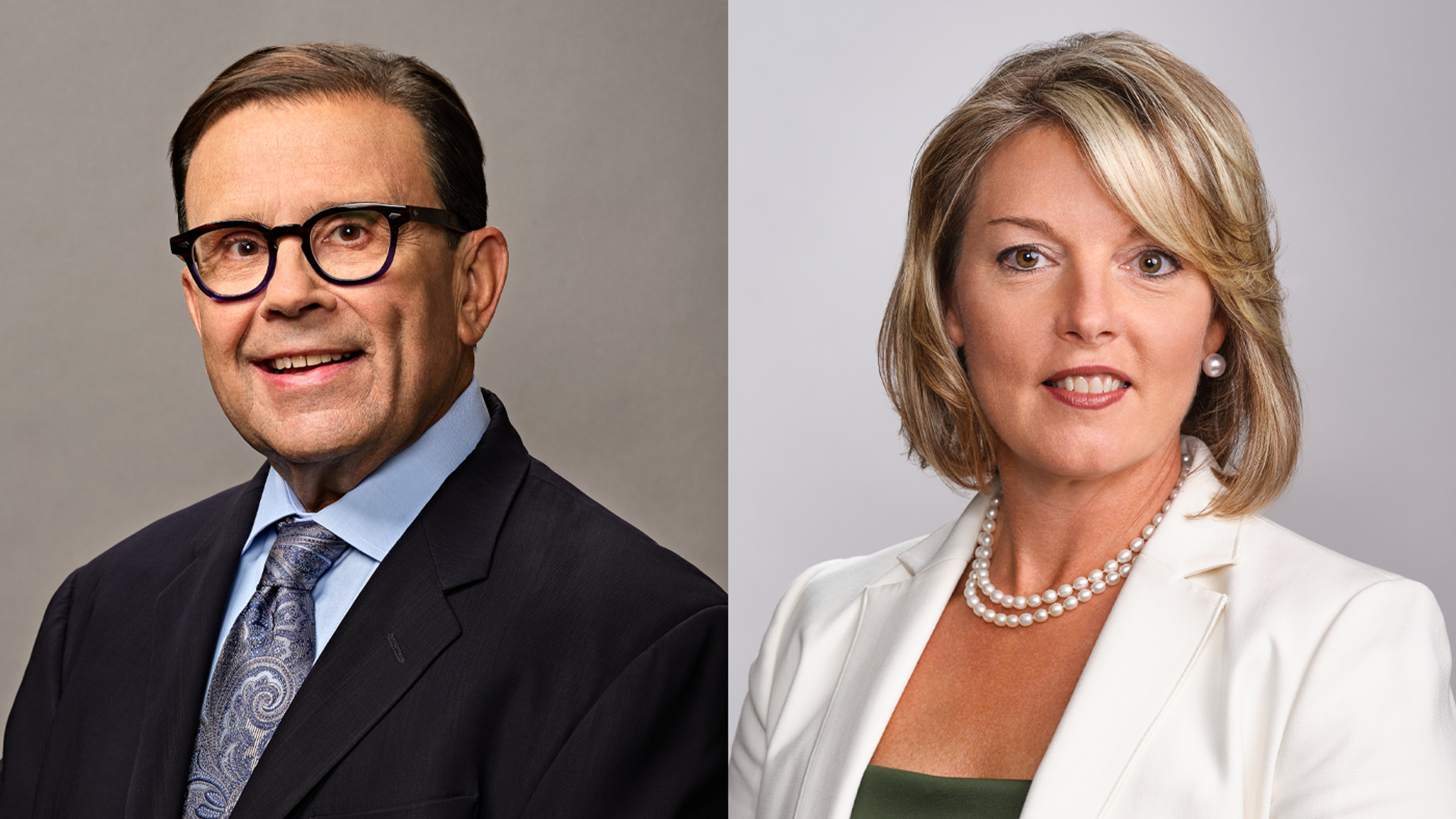

“We understand shopping for the right health care plan can be a confusing and stressful experience, but it shouldn’t have to be,” said Rick Notter, vice president of Individual Business for Blue Cross Blue Shield of Michigan. “With 38 plans to choose from, there is no shortage of valuable benefits available in every plan Blue Cross offers. We’re confident these changes will help ease the shopping experience for consumers, while maintaining the same level of support and value they have come to expect from Blue Cross.”

Members in closing plans will be moved to a new, similar plan within the same metal level and network. Blue Cross remains the only insurer in the state to offer a PPO plan on the exchange and provide coverage in each of Michigan’s 83 counties, as well as the sole carrier in the Upper Peninsula.

On average, Blue Cross PPO plans will see a rate increase of 7.5 percent and Blue Care Network HMO plans will see an increase of 8.9 percent. The rate adjustments result in part from higher-than-average pharmacy cost trends, specifically within specialty pharmacy, and an increase in the prescribing of new, high-cost medications, including drugs for diabetes treatment. A recent study estimates GLP-1 users in the U.S. may reach 30 million by 2030, or around nine percent of the overall population at an average cost of $1,000 to $1,500 per person, per month.

Blue Cross’ and BCN’s combined membership in individual plans has remained steady, with more than 153,500 members enrolled in individual market health plans, more than 65 percent of whom receive subsidies through the Marketplace.

Several benefits are included as part of all individual plans to keep members and their families healthy at no extra cost. Benefits provided at no additional cost include, but are not limited to, virtual care management, behavioral health services, oncology navigation, women’s health support and personalized care coordination for all individual Blue Cross PPO and BCN HMO plans.

About Blue Cross Blue Shield of Michigan

Blue Cross Blue Shield of Michigan, a nonprofit mutual insurance company, is an independent licensee of the Blue Cross and Blue Shield Association. BCBSM provides health benefits to more than 4.7 million members residing in Michigan in addition to employees of Michigan-headquartered companies residing outside the state. The company has been committed to delivering affordable health care products through a broad variety of plans for businesses, individuals and seniors for more than 85 years. Beyond health care coverage, BCBSM supports impactful community initiatives and provides leadership in improving health care. For more information, visit bcbsm.com and MiBluesPerspectives.com.